Brinta’s tax automation platform offers a unique advantage for businesses: it doesn’t require an ERP integration to start seeing value. For companies managing complex operations with multiple ERPs or those simply looking to simplify tax workflows without a lengthy integration project, Brinta provides a streamlined solution that works from day one. By allowing users to upload data directly through CSV or XML files, Brinta enables tax processing without any initial integration. This flexibility is ideal for businesses that want to manage tax compliance across diverse regions, like Latin America, and see immediate benefits. ERP integration is still an option for those who choose to implement it over time, providing a scalable approach to tax automation as the organization grows.

With Brinta, each tax return is customized based on the customer’s specific data structure, so there’s no need to manually reformat files or adjust data to fit the platform. This guide will walk you through the process of using Brinta’s platform to manage tax returns, from uploading data to filing, ensuring that every step is efficient, accurate, and fully compliant.

Overview of Tax Returns: Managing Deadlines and Status

Before selecting a specific tax return to process, Brinta’s Filings dashboard offers an organized overview of all the tax returns that need to be completed. This section provides visibility into each return’s status (such as “Setup,” “Review,” “Ready to File,” etc.), allowing users to monitor progress and manage workflows. Brinta also tracks due dates and organizes a filing calendar covering all tax obligations across Latin America. This centralized view helps teams stay on top of deadlines, reducing the risk of missed filings or penalties.

Using Brinta’s filtering options, users can quickly locate specific filings based on criteria such as status, tax type, country, entity, or due date, making it easy to prioritize urgent tasks.

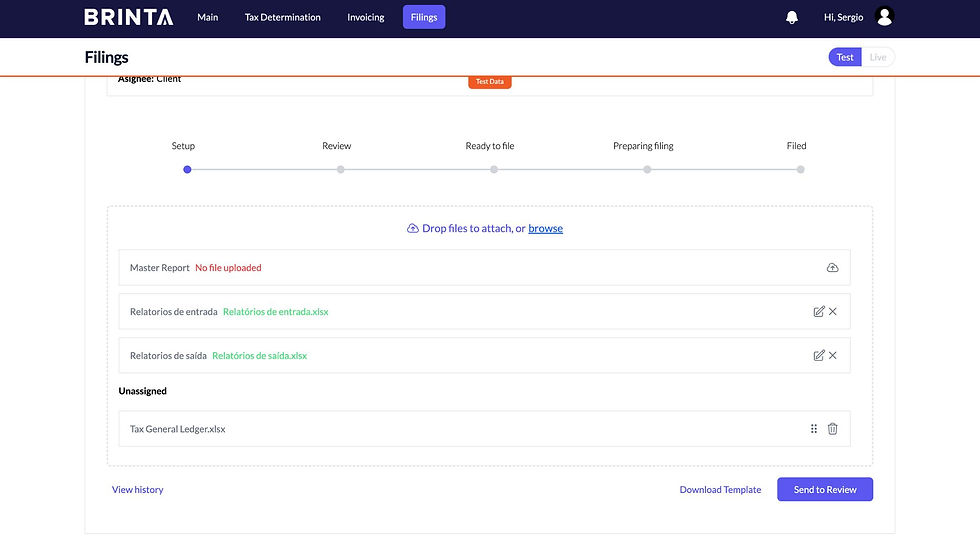

Step 1: Setup – Uploading Your Data

The first step in processing a tax return is the Setup stage, where users upload essential data files such as financial reports. Brinta reads and maps the data based on the customer’s unique requirements, eliminating the need for manual file reformatting. This customization ensures that data is organized correctly within the tax return fields, allowing you to quickly move forward with the process. Users can drag and drop files or browse to upload them directly to the platform.

Step 2: Review – Verifying the Processed Tax Return

Once data processing is complete, the tax return advances to the Review stage. Here, users can examine the prepared transmittable files along with a detailed working paper. The working paper provides in-depth analysis, validations, and cross-checks, offering a clear view of the accuracy and completeness of the tax data before it moves forward. This stage is crucial for quality control, allowing users to identify any discrepancies or necessary adjustments before submission.

At this point, there are four actions available:

Back to Setup – This option allows users to return to the setup stage to upload additional files or make adjustments. If they do so, Brinta will automatically create a new version (e.g., Version 2) of the tax return, preserving all prior data and changes. Brinta’s system maintains a full audit trail, so all actions are logged and nothing is overwritten, ensuring complete traceability.

Assign to Brinta – This option opens a support ticket linked to the specific tax return, allowing users to request assistance directly from Brinta’s support team. The support request, along with Brinta’s responses, becomes part of the audit trail, making it easy to track and document support interactions related to this filing.

Edit Tax Return – For the user preparing the tax return, this action enables adjustments to transactions or data entries that may have been incorrect in the initial upload. This ensures that any discrepancies identified during the review can be corrected immediately, without needing to return to the setup stage.

Approve – Selecting this action sends the tax return to the designated approver for final review and approval. Once approved, the return will advance to the next stage in the workflow, moving closer to submission.

The Review stage, with these actionable options, ensures thorough quality control and enables a streamlined, transparent process for preparing accurate tax returns.

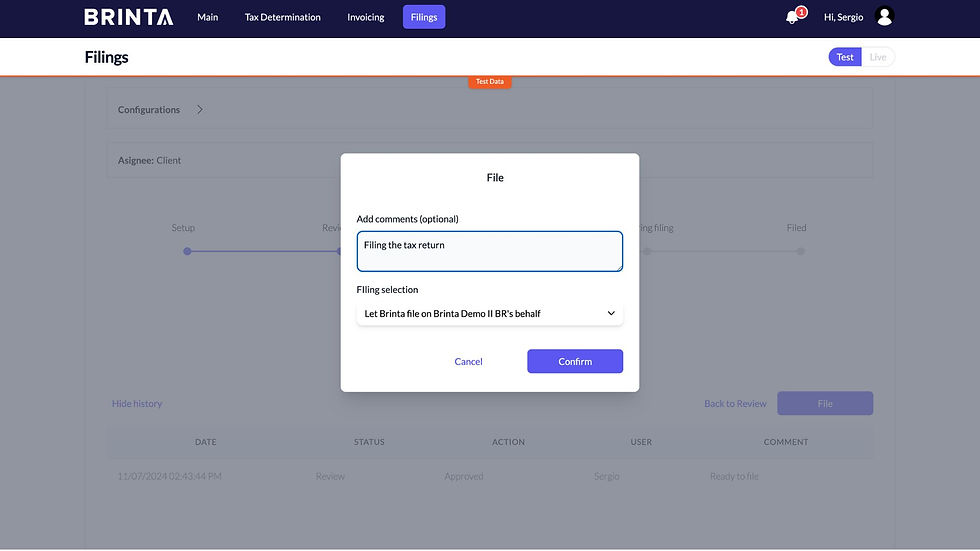

Step 3: Ready to File – Approval for Submission

In the Ready to File stage, the tax return awaits final approval from another team member. Here, they can either approve the return or send it back with comments for further adjustments. A popup provides the option to specify whether the client will handle submission manually or if Brinta will directly submit the return to the relevant tax authority via integration.

Step 4: Preparing Filing – Submission in Progress

If Brinta is handling the submission, the tax return moves to the Preparing Filing stage, where it remains until submission is completed. Once submitted, the return automatically progresses to the Filed stage. Alternatively, if the customer opts to file manually, confirming this selection will also move the return to Filed.

Step 5: Filed – Finalizing and Documentation

When the return reaches the Filed stage, it is officially marked as complete. Here, users can attach proof of payment and submission, providing full documentation. Brinta’s platform maintains a detailed audit trail, recording every step, change, and approval. All filed returns, along with their logs and audit trails, are available in the Past Filings section, making it easy to review historical records and meet compliance requirements.

Accessing Past Filings and Managing Audit Trails

The Past Filings section in Brinta’s platform stores records of all completed filings. Each record includes a comprehensive audit trail with logs of actions, changes, and approvals, ensuring full traceability. This feature supports compliance efforts by providing easily accessible documentation for regulatory reviews. Filters allow users to locate specific filings by criteria such as status, tax type, jurisdiction, or due date, streamlining access to past returns.

Conclusion

Brinta’s tax automation platform is an ideal solution for companies seeking immediate value without ERP integration. Its flexibility enables users to manage tax returns across Latin America without a lengthy setup process, and it allows businesses with multiple ERPs to consolidate tax compliance in one place. From tracking due dates to processing returns with a step-by-step workflow, Brinta provides everything needed for efficient tax management. With Brinta, businesses can gradually integrate ERP systems if needed, creating a scalable and adaptable approach to tax automation.